Review: Truebill (Best Application For Money Management?)

Recently there’s been a growing trend online wherein an increasing number of services or products are being offered via subscription-service models. A company simply charges you $20, or $50, or maybe even $99 a month to use their service or receive their product, and your credit card remains on auto-pay for continuous purchases. This is all well and good when you are actively using their service or product, and may even save time, but, are you keeping tabs on how many active subscriptions you’re enrolled in nowadays? In this article, you’ll find our review on Truebill, a service to help manage your subscriptions. For example, at the moment, I am subscribed to NomNomNow, which is a dog food company that delivers to your house. My subscription with them would be picked up and listed by TrueBill.

Years ago, people associated a subscription service with a new business or fly-by-night businesses looking to make a quick buck, but since then business has undergone quite the evolution. Today, you have industry giants such as Microsoft, or Adobe, that provide options to use their products by paying a monthly subscription price as opposed to spending hundreds, if not thousands of dollars for a license to use their product.

For my regular readers, you’ll notice that many of the products that I end up reviewing work on recurring membership. Well, being subscribed to many subscription services is a quick way to lose sight of your finances and become wasteful with your spending habits.

My TrueBill Review

Earlier last week on Instagram, I noticed an advertisement for an app called “TrueBill“. This is an app that promises to display all the services that you’ve subscribed to, how much they charge you, when they charge you, and even the option to have the company attempt to cancel the subscription for you.

Let me start off by saying that TrueBill is completely free. You do not have to pay to download the app, nor do you have to pay the company any fee for using your service. With that being said, let’s take a look into the app.

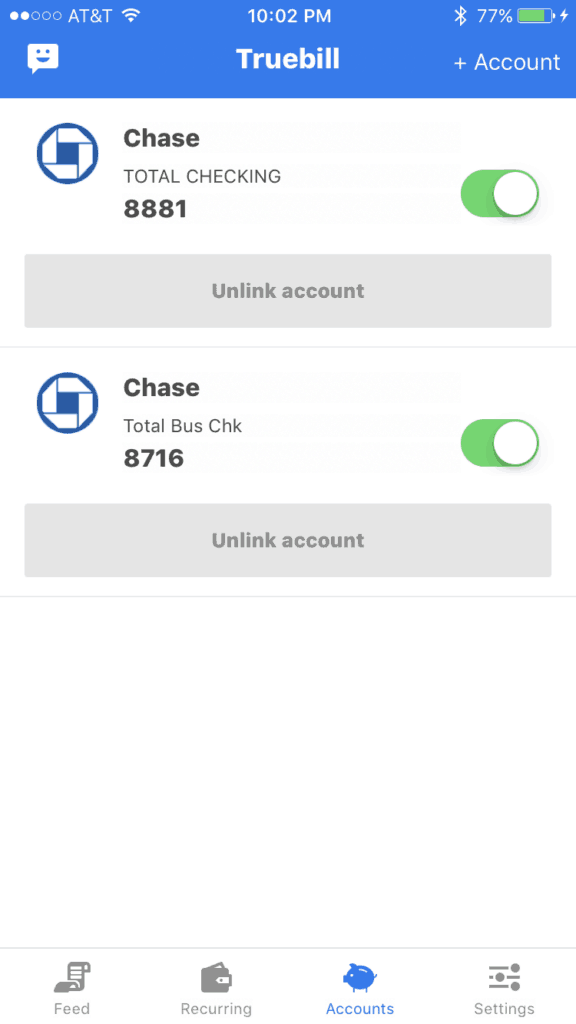

To get started, you will be asked to create an account. Once you’re done, it’s time to add your bank accounts and credit cards to TrueBill. Scary, right?

There is quite a bit of misinformation and speculation of how these accounts are connected and what sort of access do these companies have to your financials banks or cards. If you’re currently using Mint (another service I recommend), then you won’t be a stranger to connecting your bank accounts, but if you’re not, then this step might seem a bit scary or unfamiliar.

I’ll explain how this sort of access typically works. Banks, as do many online companies, provide API tools to third parties. Third parties are able to use bank’s API to collect specific information regarding an account. Pay attention to the word “collect,” third parties will never have full access to your bank account, nor can they ever initiate any transaction on your behalf using your account. Furthermore, when you enter your username and password in TrueBill, your information is relayed via a secured server, never displayed to TrueBill, and remains encrypted and secure. Ultimately, when you give TrueBill access to your banks, all you are doing is allowing them to use your bank’s API to pull information out of your account, and in this case, that information is bank statements.

The following is a statement from TrueBill in regards to their security:

The keywords to take out of their message is that they only receive “read-only” access, and that your login credentials are never stored.

Once you’ve connected your bank accounts and credit cards, you will have to wait 10-15 minutes for the application to find all of your subscriptions.

Once they’ve been found, you’ll see your subscriptions on such a screen:

Notice that under the “Feed” tab, you’ll find a timeline of all the subscriptions that you are being billed for. You will see the name of the company, the date of the billing and the amount they typically charge. You may also use this tab to figure out what you’ll be billed for soon since it does show future dates as well.

If you tap on one of the subscriptions inside your “Feed” tab, you’ll be shown all the payments you’ve made towards that company thus far. They will also inform you from what bank account or credit card that payment is being charged to, in my case, it’s to a chase account ending in 8716.

If you tap over to the “Recurring” tab, you’ll receive a clean display of all the services you are currently subscribed to. The most important figure on this page? The total sum that appears towards the upper right, which in my case displays $682.91! Yes, I have nearly $700 in monthly subscriptions, that’s insane!

If you end up tapping on one of your subscriptions from the “Recurring” tab, you’ll once again see all past payments. But this time around, if you click on “Options” on the top right, you’ll be prompted with a few options. We have the option to either rename the service, inform the app that this is not a subscription in case the information pulled is inaccurate, or “Cancel HostGator”.

So here is where the beauty of this app comes in, they actually give you the possibility of canceling your subscription via the app. What would happen if I tapped that option? Well, TrueBull would end up sending an automated email to HostGator informing them that I would like to cancel my subscription.

Will my subscription always be canceled 100% of the time using this feature? Probably not, but I bet that in most cases it will work, and it saves valuable time.

Now that we’ve come to an understanding of how TrueBill functions and what sort of features they provide, it’s time to play devil’s advocate. There is a popular saying, if you are not being charged for a product, then YOU are the product. I’m sure that inevitably, we will also become the product. What time, if and when TrueBill decides to monetize their platform, they will likely run advertisements that will ask if you want to apply to a new credit card, or sign up for a new bank account, etc. If you’re a user of Mint.com, then I’m sure you understand this concept firsthand. Now that’s not to say that you shouldn’t sign up because you may see advertisements, but there should be an understanding regarding how services such as this one intend to monetize upon growth. What do you do when they plan to show these advertisements? Simply ignore them if they don’t interest you.

Altogether, I find TrueBill to be a fantastic financial service, that is well-designed and seamless. In this day and age, with subscriptions being so rampant, I believe that the utilization of such an app is absolutely vital to staying on top of your budget. Ever since downloading this app, I’ve already begun to unsubscribe from services that I completely forgot about, and have already placed myself in a position to save myself $240 per month.

To end this review, I want to say that I am NOT affiliated with TrueBill in anyway. I am NOT being compensated by TrueBill in any way for this post. Even moreso, they never reached out to me and very likely don’t even know about my website. The only reason why I am wholeheartedly recommending their service is because of the value it provides to the everyday consumer.

Truebill has been nothing but BS to me. They tempted me in will lowering my cellphone bill, but instead, it went up a few cents, and I’ve had to pay them $12.44 a month for 6 months. I am so done with their “services”. I tried contacting them several times, and they say that they have “saved” me money when in fact it was a let’s take this amount of money off of here, and add it to a different part of the bill. $74.64 dollars worth of a freaking scam.