Is Motley Fool Worth it? “Stock Advisor” & “Rule Breakers” Review

In 1 month, up $6,322 (28%) on $22,728 invested!

Six years ago, I was your typical stock market investor, I simply placed money into a mutual fund once per month, and that’s as far as my involvement in the market was. Just as you are right now, at some point I decided to become more selective in the companies that I invest my money in. Heck, we’ve all heard the stories about someone who invested heavily in Tesla or Amazon years ago, and came out like bandits!

For the last 5 years, I’ve been doing my own research and investing in various companies. I’ve had some great picks, and some poor picks, but overall, I’ve definitely enjoyed being more involved with my money. It wasn’t until two months ago that I decided to take a look at Motley Fool’s premium services, especially since they’ve been around for 30 years and are well known in the investing community.

Before we get started, I’m going to start off by saying that I am going to be brutally honest about Motely Fool’s services. I’m going to talk about the good, and the ugly, more importantly, I am going to discuss why their service isn’t meant for everyone. A key point that we will touch on is why their historical performance is very difficult if not impossible to replicate.

Controversial Opinions About Motley Fool

If you’ve read a few reviews about Motley on various forums such as Reddit or Quora, you’ll notice that there is quite a lot of negative sentiment towards receiving trading advice from them, why is that?

1) Freemium Fool vs Premium Fool

In my opinion, the vast majority of those negative reviews come from people that talk about the “free version” of Motley Fool, instead of commenting on their paid version. Motley Fool publishes an insane amount of content on their Fool.com domain, which is available to everyone. What’s important to take note is that that Motely has hundreds of different contributors that write for Fool.com.

Well, what does that mean?

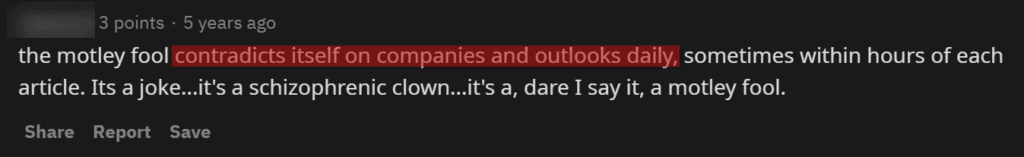

Different contributors have different opinions. One contributor might say that stock X is a buy, but another contributor on the same day might say that stock X is a sell. Naturally, when someone notices contradicting viewpoints on the same platform, it seems like no one truly knows whether or not the stock is a buy or sell.

Let’s look at a few of these complaints on Reddit:

In the first two screenshots, you can tell that the posters are upset with Fool because of the contradicting opinions. But again, those contradictions occur on the free version of Fool aka Fool.com, since there are hundreds of different contributors.

The last screenshot is an example of someone that made some purchases due to the recommendations on the free Fool platform. Now, since I personally have a “Stock Advisor” and “Rule Breaker” subscription, I checked to see whether any of those three tickers were ever recommended by Tom or David (the owners of Fool, and the ones who make the picks for the premium side), and nope, none of those tickers were ever recommended by them.

So moving forward, when you read a review of Motley Fool, try to see if they’re talking about the premium side of the website or the free side of the website.

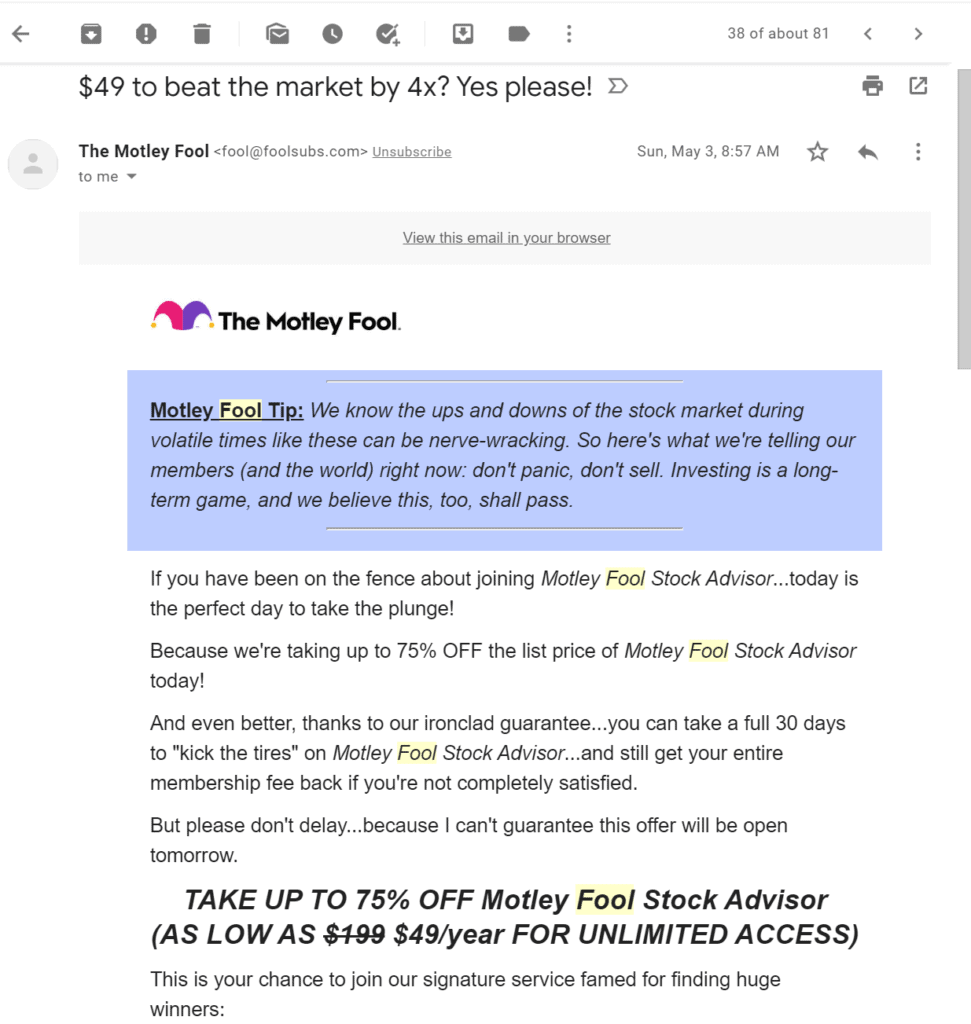

2) Non-stop Promotional Spam from Motley Fool

Whether you made an account on Fool, or simply gave them your email address, you’ll quickly notice that on a daily basis, you receive promotional emails from them. There is no excuse here for Fool, they definitely do go overbroad with the promotional emails, and it will turn people off from their services.

The good news is that it’s not too difficult to unsubscribe from the promotional emails.

When you are logged into your Fool account, simply head over to your “Account” page, followed by “Communication” or click here. From there, you’ll have options to subscribe from promotional emails:

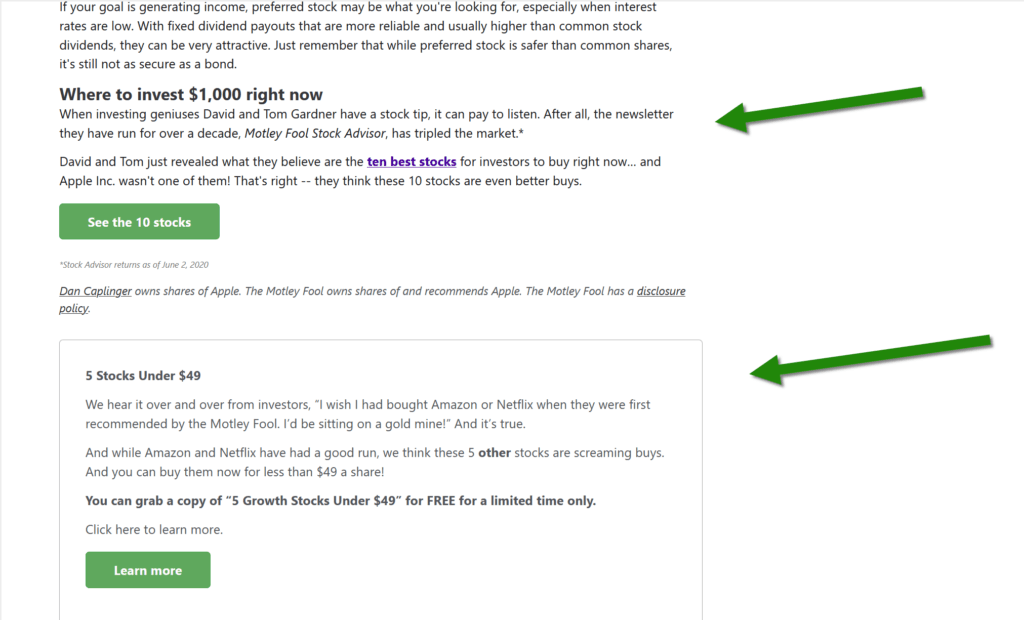

3) In Your Face Advertising

If you’re ever browsing a finance website, you may notice some banner ads that belong to Motley Fool, and commonly, you’ll notice “clickbait” like headlines such as “That 1 stock you must own for 2020!”, or if you read an article from Motley Fool, and it could be on any topic, the article always finishes with a bunch of plugs to their paid services:

These are two plugs to their paid services, back to back, on an article that is discussing the difference between common share and preferred shares. Now here is the crazy part, even as a paid customer, when you access the “Premium” content, you will still find the promotional text at the bottom of every article for another product of theirs!

Anyhow, it’s pretty clear at this point that Motley Fool’s marketing department is extremely aggressive when it comes to acquiring new customers. The obnoxious marketing and the contradictory opinions on their free content are the two components that typically drive the negative sentiment you’d find online about their services.

Motley Fool “Stock Advisor” & “Rule Breakers” Review

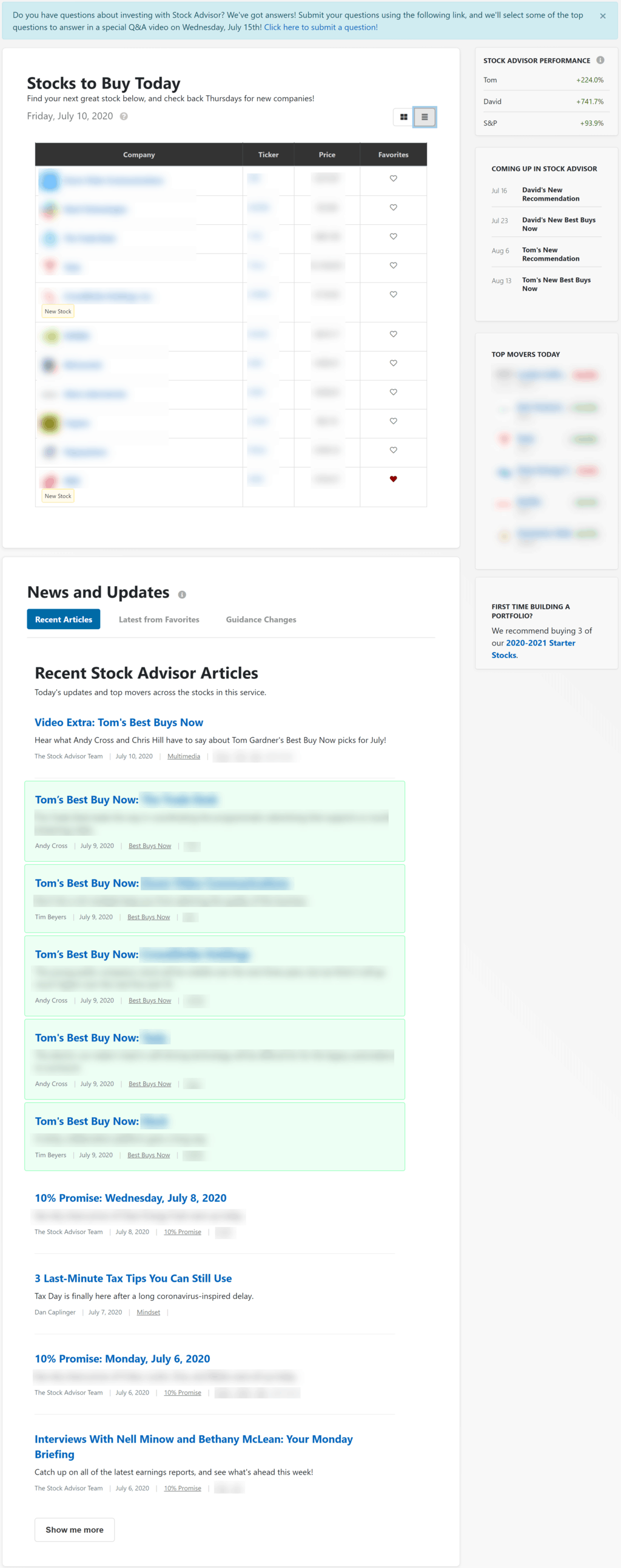

Time for the juicy part! We’re going to be covering the interface that you’d expect as a paying customer. The reason why I am grouping both services in one is due to the fact that the interface between the two is exactly the same.

As you view the images below, you’ll notice a lot of blurring, and that is due to the rules of their TOS. I cannot show stock picks or information that they put out for their paying customers. I can help you understand what to expect on each page, but that’s far as I can go.

Stock Advisor

Stock Advisor is the flagship service offered by Fool. It’s been around for the longest, and it’s the first service that is promoted to new customers. As of 2020, the annual subscription cost is $100, but as a new customer, you should be able to snag a discount which would bring your first-year subscription down to $50.

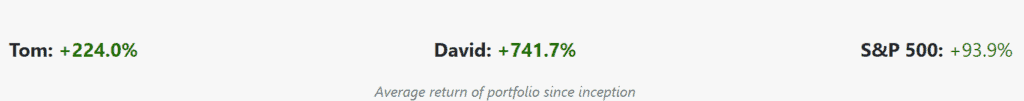

If you’ve spent any time on Fool, you’ve probably seen a bunch of their “historical returns”, so it won’t hurt to look at it again:

Inception would be 2012.

So at first glance, what probably sticks out the most is David outperforms his brother overwhelmingly. Personally, I wouldn’t be too much stake in that since it could simply be a scenario of David having some bombshell hits early on, such as Apple or Amazon. Overall, they do outperform the S&P 500, which is nice to see. But, going back to the introduction, we’ll discuss a bit later why we can’t take things at face value.

But alright, let’s say you just bought a subscription, what’s the next step?

“Home” for Stock Advisor