Yotta Savings – a savings account with a prize incentive.

If you’re an American, then this might sound completely foreign to you, but that’s because such a savings account was illegal until 2016. Even as I write this review, such a system isn’t completely legal in all states!

If you’ve had the chance to see an advertisement for Yotta Savings online, or watched a video review, then you’ve seen the sort of prizes that are up for grabs, such as a Tesla, or even $10,000,000.

But what’s the catch, and is it better than a typical savings account. In this review, we’re going to cover my opinion of saving accounts, whether or not Yotta Savings is legit, and what my personal experience has been so far.

Yotta’s Interest Rates vs Average Savings Account

For starters, if you’re holding money under your mattress, or in a checking account, you are losing purchasing power with your money every single year. The average inflation rate in the US is 2%, so your $1,000 today will have $980 in actual purchasing the following year.

With that being said, there used to be a time that you could deposit money into a savings account or a CD and receive as much as an 18% annual interest on a 3-month CD! What sort of interest rate do you get nowadays? Let’s look at this interactive chart from BankRate:

Before the Financial Crisis of 2008, it was possible to see rates of around 3-6%, but nowadays, you’ll be lucky to even find 0.50% APY (annual percentage yield).

Here is the thing, if you’re receiving a 2% APY on your money, then all you’re doing is preserving your capital’s purchasing power. But, if you’re receiving a rate ABOVE 2% APY, then you are not only preserving your current capital but actually growing it. You’re slowly becoming more and more wealthy with each passing year.

In 2020, we can forget about trying to build our wealth with a savings account, the best we can do is try to preserve our current capital.

The average savings account interest rate for 2020 is just 0.05%. Yes, you read that right.

Fortunately, there are dedicated companies out there that attempt to offer the most attractive rates, one being Chime, which offers a 1% APY. As it stands, this is the best rate you’ll find online, so going back to our original example, your $1,000 would have $990 in purchasing power with a 1% APY rate in a year, as opposed to $980 if it sat in cash.

Enter Yotta Savings, a company that seems to offer a 3-4% APY! If Yotta’s APY stands the test of time, then you’ll see actual growth on your savings, instead of losing to inflation.

How does Yotta Savings work?

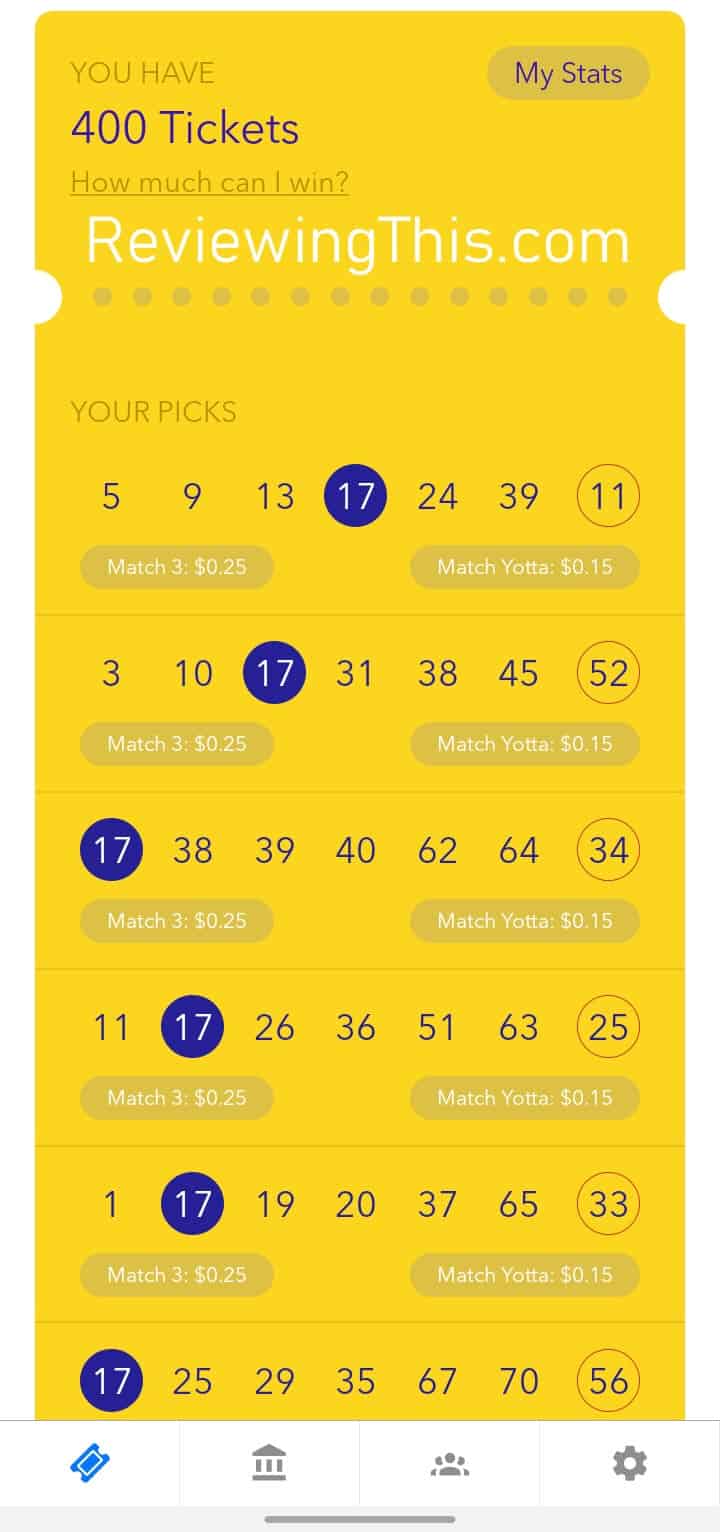

For every $25 that you deposit with Yotta, you receive 1 ticket.

With each ticket, you select 6 numbers from 1-70, and then a “Yotta” number, which would be similar to the PowerBall number.

A number is drawn every night at 9 PM EST, so it is a weekly drawing.

Here is the beauty with this lottery system, if all you have is $25 deposited with Yotta, then every single week, you will have 1 available ticket to win with. You NEVER lose your ticket count. Even better, as your account grows from the interest collected, and the prizes won, you gain more tickets.

What Yotta does is first guarantee you a 0.20% APY, and then you have the possibility to win additional money with your free tickets. So a 0.20% APY is 4x higher than the average savings APY, but it is only 1/5 of Chime’s rate, but the tickets change the formula altogether.

This might seem like a weird way of handling a savings account, but this isn’t a new concept. The United Kingdom has been offering a prize-based savings program for years with great success. If you buy “Premium Bonds” from the government, you’ll receive a guaranteed 1% APY, and a chance to win over $1 million dollars once per month.

Yotta Prizes

Let’s take a look at what prizes you could win with your Yotta tickets:

The biggest prize is $10 million dollars, but the chances of matching up every single number is 0.00000073%. – ouch!

The biggest prize is $10 million dollars, but the chances of matching up every single number is 0.00000073%. – ouch!

On the other hand, for the lowest prize of 10 cents, your chances of matching up just the “Yotta” ball is 2.2%.

There was a YouTuber by the name of AskShebby that did the math to find out what your expected return is from participating in this draws, and the answer is 3.81%. This is calculated with the inclusion of the 0.20% guaranteed APY, with an estimate that there are a total of 500,000 tickets in the current draws. ($12.5m deposited with Yotta)

If you pay close attention to the prize chart, you’ll notice that the large prizes have an asterisk next to them, which means that those prizes are split between the winners. So, if two different people had the same ticket that won them the jackpot, they would have to split the $10m. The lower prizes do not have any splits.

A question you might have is “If more people deposit and participate, wouldn’t that lower yields since there can be more and more splits?”. Great question, and yes, that is the case. The good news is that all the split prizes are very difficult to win, so factoring in a split for those prizes barely affects the expected yield over a year’s time. Most of the yield is derived from winning the smaller prizes, which do not split.

For example, going from 500,000 tickets to 6,000,000 tickets only lowers the overall yield to 3.14%.

Is Yotta Savings insured and fair?

Yotta is FDIC insured, which means that the U.S government will insure your deposit for up to $250,000.

In terms of the lottery picks, Yotta uses a third party insurance company to run the lottery, which means that each party is blind to the other party..

My Experience with Yotta Savings

As I write this review, this is my first full week with Yotta. I will say that it is easy to sign up to them, connect one of your bank accounts to their app, and initiate the deposit. They are also nice enough to credit you with your tickets before the deposit fully clears on their end.

My $10,000 deposit:

You can see my pending deposit, along with my current $0.75 winnings. So even though I joined late last week, in the middle of a drawing, they still let you participate, and I was able to have a few winnings tickets. (I mostly matched up some “Yotta” numbers).

When it comes to the guaranteed 0.20% APY, that is paid out to you at the end of each month, and it would be prorated.

I’m writing this review on a Tuesday afternoon, so there has only been one draw so far (Monday), but this is how things are looking like for me: The number on Monday was “17”, and I had 37 tickets with the number 17 in them. Keep in mind, it doesn’t matter in what order you match up the numbers, except for when it comes to the “Yotta” number. (the last one)

The number on Monday was “17”, and I had 37 tickets with the number 17 in them. Keep in mind, it doesn’t matter in what order you match up the numbers, except for when it comes to the “Yotta” number. (the last one)

If you’ve been reading this far down, and you like what you’ve heard so far, I do ask you to please use my referral code when signing up, it is MARTIN18. If you do use the code, then you and I will each receive 100 tickets. These are tickets that will never disappear and will always be in play every week. You’d have to deposit $2,500 just to get 100 tickets without the referral code!

In the event that you do want to signup, you can only do so via mobile, by either downloading their app from Apple’s App Store or Google’s App Store.

What return should I expect with Lotta Savings?

Well, we know that if our $10,000 deposit was with Chime Bank, then we would expect $100 (1%) paid out in interest in a full year.

If we take that amount and divide it by 12 months, it comes out to $8.33 per month. If we divide it by 52 weeks instead, then it is $1.92 per week.

On the flip side with Lotta, we first receive the 0.20% guaranteed interest which is only $20 per year on a $10,000 deposit, and it comes out to $1.60/mo or 38c/week.

The numbers that we are comparing is the 38c per week from Lotta vs $1.92 per week from Chime. That means we need to earn $1.54 in prizes every single week just to match the 1% APY by Chime Bank.

Earlier in this review, we spoke about how the expected return with Lotta is 3.81%. What we’ll first do is remove the 0.20% APY from that number which gives us 3.61%. Now we know that 3.61% APY should be completely earned via prizes. That percentage equates to $361 per year, or $30 per month, or $7.50 per week.

$7.50 per week, that is how much I am expected to earn in prizes per week on average. Understandably, there will weeks that we earn less in prizes, and there will be weeks during which we make more, but ultimately it should average out to $7.50 under the current odds and prizes.

If we earn less than $1.54 in weekly prizes, then we are earnings less with Yotta than we would be with simply depositing with Chime @ 1% APY.

Why you might want to avoid Yotta

Now that we got the good out of the way, let’s talk about a few drawbacks.

Addiction

The first point I want to discuss is addiction. Gambling is a serious addiction, and even though at face value there is no “cost” for gambling with Yotta, there is a cost of lower returns.

There are two staples for growing your wealth, and that is real estate and the stock market. You could simply buy into a Mutual Fund that follows the S&P 500, and based on historical returns, you’d see a 7-8% return (after inflation!)

If you have an addictive personality, that please remember that for your future, there are better investments out there.

Even though I am not a financial advisor, and I am not giving you professional advice, this is my opinion on how you should save:

- 3 months of expenses are in your typical checking/savings account, such as Chase. (emergency fund)

- 12 months of expenses are in your Yotta account (funds you’d use for a car purchase or a house downpayment)

If you have paid off all your debt (except for the mortgage), then fill up your 3-month emergency cash, then fill up the 12 months of cash in Yotta, and then every dime over that should go into higher-yielding investments, such as the stock market.

Do not keep shoving money into Yotta after every paycheck just to chase for more tickets, and to try to improve your odds of winning $10m.

Lower yields in the future

Yotta is still a relevantly new company, and there is a very good chance that their guaranteed APY & prizes can change with time. As more people join and deposit, the more Yotta will have to continuously payout for the small prizes since they aren’t split. There is a possibility that Lotta is willing to burn money for the time being using venture capital money, but that isn’t a sustainable model, and at some point, they’ll have to lower the prizes to become profitable.

If at some point in the future, the expected return of the guaranteed APY + prizes comes out to be below 1%, I can no longer recommend them. At that point, you are gambling with your savings account, since you can get a guaranteed rate from Chime at 1%.

Future Updates

I intend to continue updating this review as the months go by. There is a good chance that I will add more money to the account, but I will be documenting everything in this review. If you have any specific questions, just throw them in the comment section below.

November 2020 Update ( 1 full month of using Yotta)

October has come to an end, and I’ve now had the chance to have my money invested with the company for a full month. So how much did I make? Did I underperform the 1% APY that is guaranteed by Chime Bank, or did I knock it out of the park? Let’s look!

So towards the end of September, we deposited $10,000 with Yotta Savings. Since then, that deposit has grown to $10,009.18; so I’ve earned $9.18 in interest. Unfortunately, not all of that is attributed to the month of October, since we did receive a little bit of interest when we joined the last month of September – 76 cents.

So towards the end of September, we deposited $10,000 with Yotta Savings. Since then, that deposit has grown to $10,009.18; so I’ve earned $9.18 in interest. Unfortunately, not all of that is attributed to the month of October, since we did receive a little bit of interest when we joined the last month of September – 76 cents.

If we take $9.18 and subtract 76c from it, we get $8.42.

During October, we earned $8.42 in interest on $10,000.

What does that mean percentage-wise?

My money has grown by 0.0842% in 1 month. If we annualize that rate, it comes out to 1.01%.

Ouch, that means that we barely beat the returns we would have received with Chime Bank. More importantly, that figure considerably underperforms the expected 3-4% APY return we calculated earlier in this review.

Before any of us get discouraged, it’s important to remember that this is only my first full month of using Yotta. It wouldn’t be fair to make a full assessment of the service until we have our money invested for a full year. Who knows, maybe this month will turn out to be the lowest month, and it’s only up and up from here?

Below is how our earnings looked like on a week by week basis:

For clarification, “Prize” type refers to the weekly lottery drawing, and the “Savings Bonus” type refers to the guaranteed 0.20% APY that is paid by Yotta. For our best week, we saw a prize of $2.00, and for our worst week, it was $1.40.

For clarification, “Prize” type refers to the weekly lottery drawing, and the “Savings Bonus” type refers to the guaranteed 0.20% APY that is paid by Yotta. For our best week, we saw a prize of $2.00, and for our worst week, it was $1.40.

Update April 18, 2021: There have been many changes to Yotta since this review has been written, and we are working on a write-up of the new changes!

Can we still use ur referral code to sign up?

Yes, it’s still valid!

Thanks, I used your referral code and got one dollar and 1,000 tickets. I actually think this is a fun idea and am surprised I haven’t really heard that much about/that its not more popular. My current plan is to test it out for about a year and see how much I earn/if I like using it.

(fyi, there is a little typo in your bio: All the reviews you’ll find here have been personally reviewed my someone on the team!…I think the “my” is supposed to be by 🙂